Dalton/Whitfield County Residential Sales Days on Market Report: September 2023

Dalton/Whitfield County Residential Sales Report: September 2023

September marked the second lowest sales month of 2023, surpassing only June’s 38 Closed Sales. Month-over-month, we witnessed a significant drop in sales, plummeting from 52 Sales in August to just 40 in September, reflecting a 23.1% decline.

This fall in sales was accompanied by a stagnant growth in active inventory, holding steady at 123 Active Listings for the second consecutive month. To provide context, a comparison to the past reveals that last year, from August to October, active inventory grew by 25%. However, this year, during the same period, inventory shrunk by 9%. Moreover, a glance at September 2022 Closed Sales shows 46 transactions, which decreased to 40 in 2023.

Drawing from the experience of the previous year, once we witnessed a decline in sales volume, a significant resurgence was not observed until February of 2023. This trend is worth monitoring closely. Sales, much like our inventory, may continue to remain severely low over the approaching holiday season.

Remember, the best way to learn about your local market is through a local realtor, not the national media. While there are factors that play into every market there are many that differ on the local level. So whenever you need to know about the local market contact me!

Jacob B. Mitchell

Cell: 706-581-6401

Office: 706-226-5182

Email: AgentJacobMitchell@gmail.com

www.RealtorJacobMitchell.com

Coldwell Banker Kinard Realty

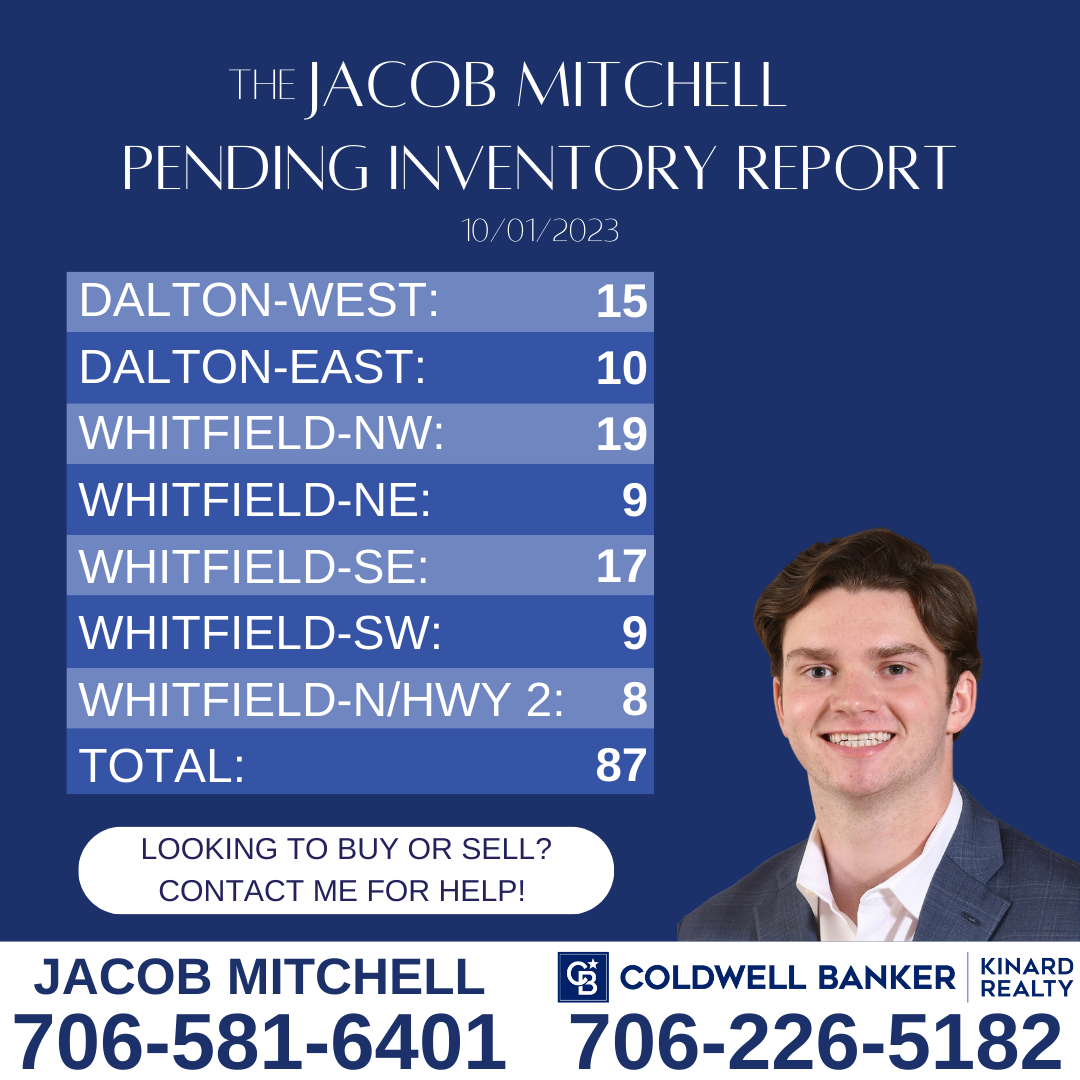

Dalton/Whitfield County Pending Inventory Report: October 2023

Dalton/Whitfield County Residential Inventory Report: October 2023

At the start of October, our residential inventory in the Dalton/Whitfield County market remained stagnant, mirroring the figures from the previous month, with a total of 123 active listings. Understanding the implications of zero growth in active inventory month-over-month is crucial to comprehend the current market dynamics.

To grasp the significance of this trend, let’s compare it with October 2022. Last year, we began October with 186 active listings, reflecting a considerably higher inventory compared to this year. Moreover, in September 2022, we witnessed 46 closed sales, resulting in a months supply of 4 months for October 2022. However, this year, with only 123 active listings, we start October with a reduced months supply of just three months, underscoring the decline in inventory.

This decline of an entire month in the year-over-year months supply is a direct indicator of our market grappling with low inventory, presenting challenges in meeting demand. The contrasting statistics of a 33% decline in year-over-year active inventory against a 14% decline in year-over-year closed sales suggest that we might be heading in an unfavorable direction.

Reviewing the historical trends, we note that last year, active inventory peaked in October, remaining consistent in November before plunging for six consecutive months, eventually reaching a mere 75 active listings in May 2023. If this historical cycle repeats, we could soon find ourselves in an extremely scarce environment concerning active listings within the upcoming months.

Remember, the best way to learn about your local market is through a local realtor, not the national media. While there are factors that play into every market, there are many that differ on the local level. So whenever you need to know about the local market contact me!

Jacob B. Mitchell

Cell: 706-581-6401

Office: 706-226-5182

Coldwell Banker Kinard Realty

August 2023 Residential Market Report: Calhoun/Gordon County

August 2023 Residential Market Report: Chatsworth/Murray County

Dalton/Whitfield County Residential Sales Price Report: August 2023

August 2023 Residential Sales Report Average List Price/Sold Price % : Dalton, Whitfield County

Dalton/Whitfield County Residential Sales Days on Market Report: August 2023

Dalton/Whitfield County Residential Sales Report: August 2023

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link